The Significance Of A Financial Strategy - Selecting An" Advisor "

The Significance Of A Financial Strategy - Selecting An" Advisor "

Blog Article

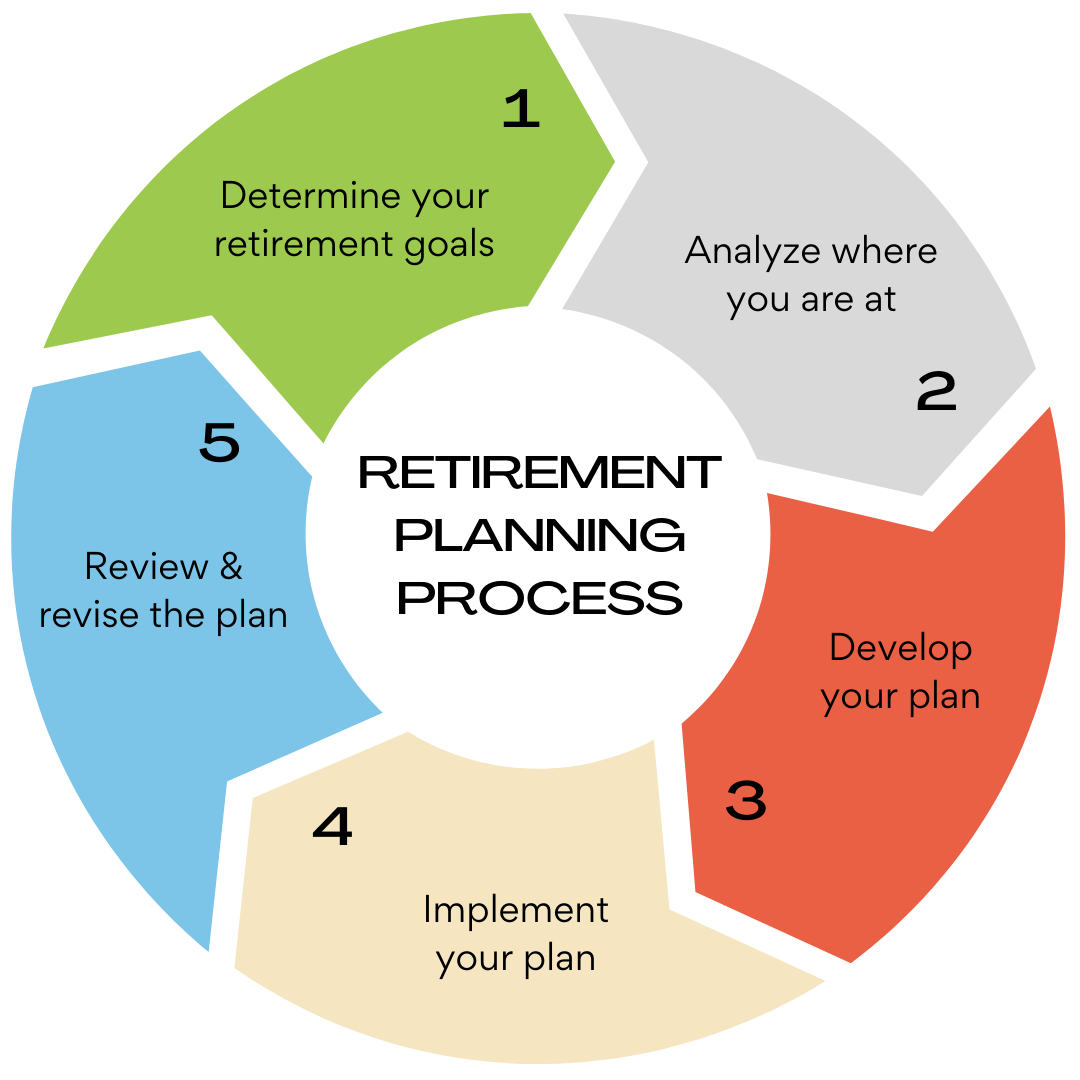

You must understand precisely what you desire to perform in the future when you have to decide about retirement preparation. You must never start preparing your retirement a couple of months before retiring. On the contrary, you must have a great deal of time to prepare it very thoroughly. There are many aspects to consider when preparing for retirement. In this article, we are going to look at a few of the factors that you need to think about when doing your retirement preparation.

Putting 'something' towards retirement is not likely to yield the rewards you would want come retirement age. This goal needs to be far more specific. It does not have to take long to work out. For example, you might think of how much income you want to live off, or think you might live off and be happyily retired.

Women likewise are danger averse when it pertains to investing, selecting to invest in conservative investments and bonds which have actually ensured returns however lower general returns. You'll protect your capital but you will not have much to show for it when you retire and begin making use of those cost savings. So the option is either have more cash working for you in low, however safe, financial investment vehicles as you near retirement or invest more strongly.

Even if you are not being offered the 401(k) plan, there are different methods you could obtain yourself of that will help you in your retirement planning. Learn whether the 403(b) or the 457 plan has been made offered retirement activities to you. If so, consider yourself fortunate since half of the tension from retirement can be alleviated with the aid of these strategies. Even if you are not being offered the above two strategies, do not fret since help is constantly at hand in the type of IRAs. A few of the employers are known to provide their labor force with different matching programs similar to the 401(k) plans.

Most employers provide a 401(K) plan, complete with matching contributions. This is an excellent and hassle-free alternative, but many lose out by not contributing enough. Likewise, a 401(K) is tax-deferred. This is great, because the contributions are able to grow penalty-free, but the drawback is that they are taxed when the cash is withdrawn.

It is necessary to understand what your earnings will look like at retirement age. What will your social security benefits look like? At what age do you mean to retire? Will your home/auto/boat be paid for?

Accept that the world is altering and will never be the same as it was in the past. Accept the change, be versatile and adapt as things change around you. Wishful thinking must not be the basis for your retirement preparation. "It is not the greatest of the types that endure, not the most intelligent, but the one most responsive to change"-- Charles Darwin.

Research other sites with comparable content to see how they handle navigation. You might be able to combine certain locations under one button and after that break them down later on in the website. Many people can easily handle about 5 buttons to click. As you add more than that you are adding not just more complexity to the site however are likewise risking the stability of the function.